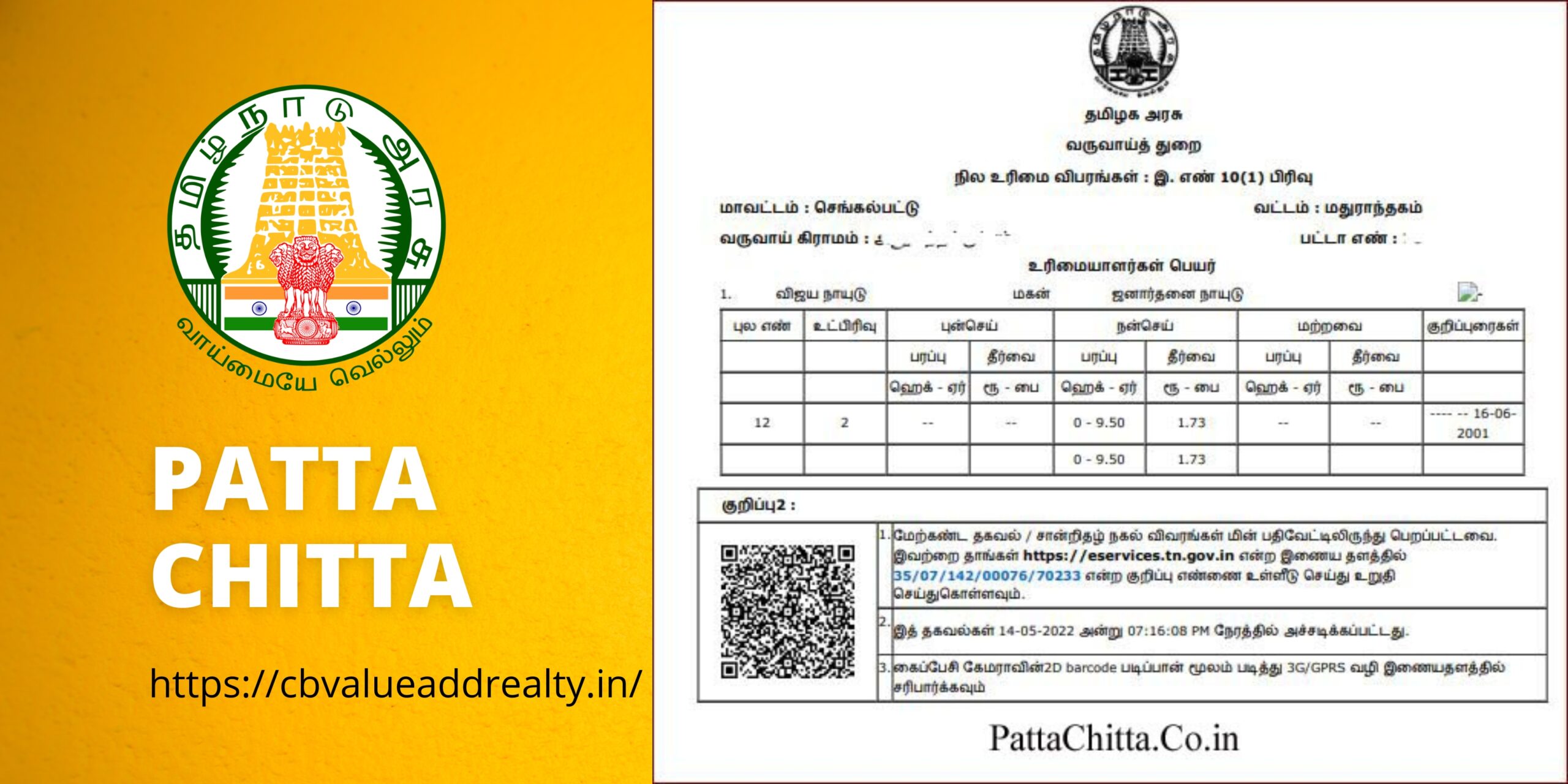

Encumbrance/ Chitta / Patta

Encumbrance/Chitta/Patta is required for any buying and selling the property. Please do let us know your need. We will procure these for you from local registers office.

We give Various online solutions are also available for our clients to simplify their daily tasks. We are providing end-to-end service management for properties is the business of property management.

Documents Required

- Details of Land number etc

Timeline & Cost

- 2 Weeks - Encumbrance/Chitta/Patta

Disclaimer

Oorlahelp facilitates procurement of documents from tamilnadu and we are not responsible for any delay from government offices.

In tamilnadu, Encumbrance/Chitta/Patta will be provided in English and Tamil and we are not responsible for any errors/mistakes in name provided by client.

We cannot be held responsible for any delays in government offices or delays due to insufficient or delayed information /documentation provided by the client.

Frequently Asked Questions

Whether you have a question or a doubt, we will be able to answer it hassle-free and trustworthy.

Oorlahelp helps you in getting encumbrance/khata/patta or 7/12 Certificate with a signup in Oorlahelp.com , place an order with necessary details and documents. We will verify the documents and provide the estimate.Once after your approval,based on timeline mentioned in services,you will be receiving the certificate.

We will provide original certificate with government seal.After getting the certificate,please check in registation website with the details. There you can easily verify your certificates and other documents. If you require assistance with the same, feel free to reach out to us at our helpdesk.

Details of the property and it's location are needed to get encumbrance/khata/patta or 7/12 Certificate.

Oorlahelp provider will fetch encumbrance/khata/patta or 7/12 Certificate and will email you a copy after placing an order for a encumbrance/khata/patta or 7/12 Certificate,filling out the required details and uploading the documents.